What Does Whole Life Insurance Louisville Mean?

Wiki Article

Life Insurance Online - Truths

Table of ContentsWhole Life Insurance Things To Know Before You BuyLittle Known Questions About Cancer Life Insurance.More About Life Insurance CompanyWhat Does Whole Life Insurance Louisville Mean?Life Insurance Louisville Ky Fundamentals ExplainedExcitement About Whole Life Insurance

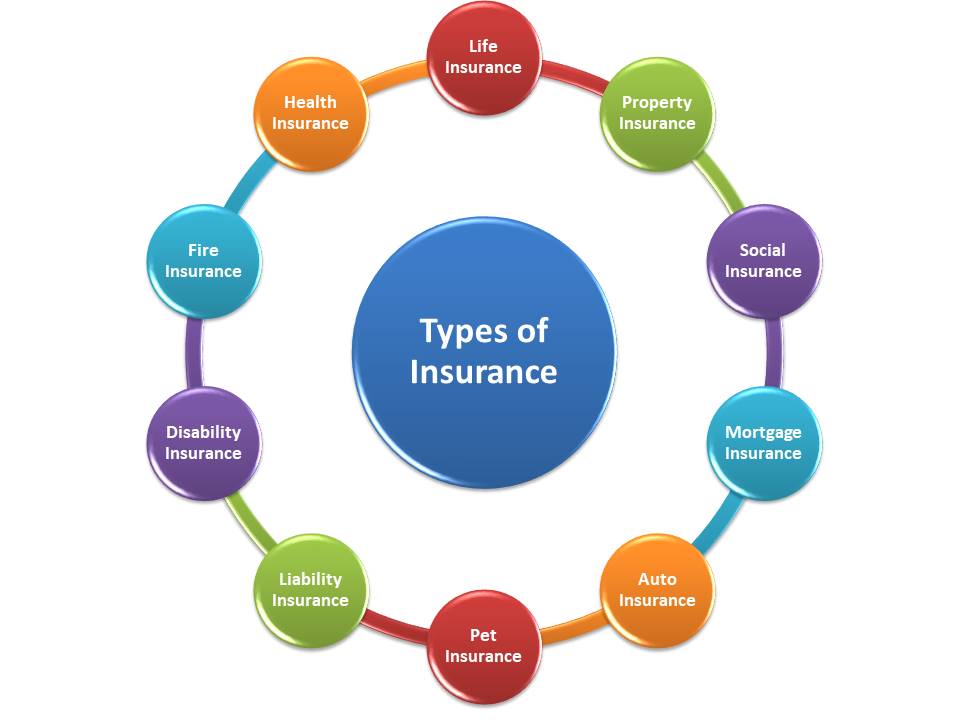

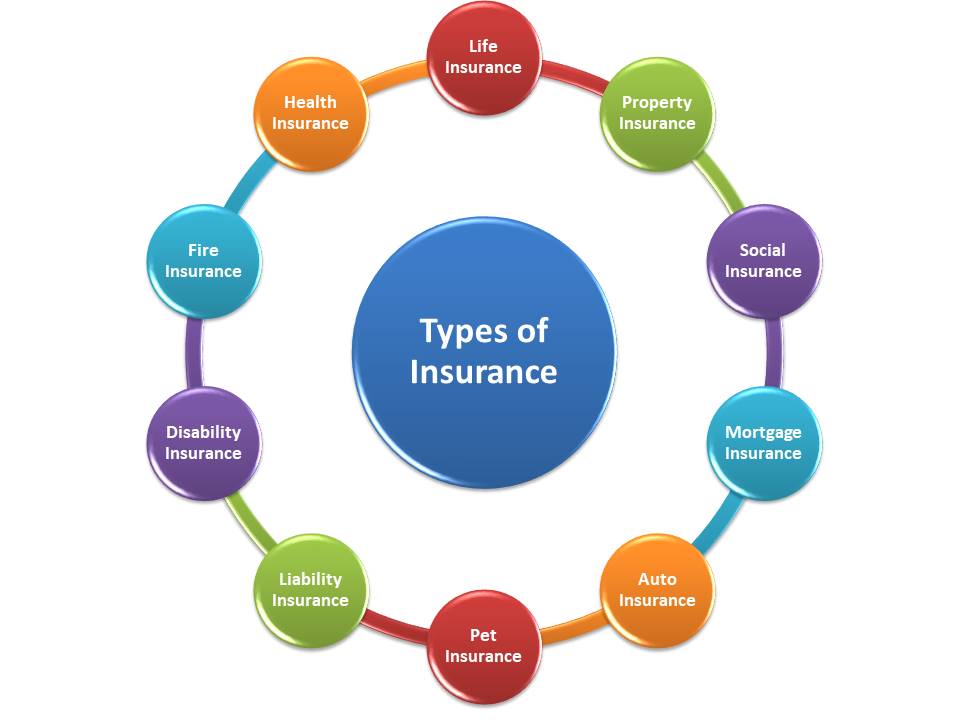

If you drive without automobile insurance as well as have an accident, fines will possibly be the least of your financial problem. If you, a passenger, or the other driver is hurt in the mishap, vehicle insurance will certainly cover the costs and also help safeguard you versus any kind of lawsuits that might result from the mishap (Whole life insurance Louisville).Once again, as with all insurance, your specific scenarios will identify the expense of automobile insurance. To ensure you get the best insurance policy for you, compare numerous rate quotes and also the protection given, and inspect periodically to see if you get reduced rates based on your age, driving document, or the location where you live.

If your employer doesn't provide the kind of insurance you desire, obtain quotes from a number of insurance suppliers. While insurance is expensive, not having it could be far extra expensive.

The Best Guide To Kentucky Farm Bureau

Insurance policy resembles a life vest. It's a little bit of a nuisance when you don't need it, yet when you do require it, you're more than appreciative to have it. Without it, you could be one car wreckage, ailment or home fire away from drowningnot in the sea, but in financial obligation (Whole life insurance Louisville).

The Best Guide To Term Life Insurance Louisville

Crash protection. This covers the price to repair or replace your car if it's damaged or damaged in a wreck. Comprehensive protection. This level of insurance policy covers your losses that aren't brought on by an accident such as burglary, criminal damage, flooding, fire and also hail. Once again, an insurance policy representative is a good source to help you determine the level of defense you need based upon the type of cars and truck you drive.

An additional note concerning home owners insurance: Talk to your agent about what your plan covers as well as what it does not. Most homeowners don't understand that flood insurance coverage is omitted from their policies. Flooding insurance policy is additionally different from water backup protection. Ask your agent to go over the information with you. Relying on where you reside in the country, quake insurance coverage may not be included.

Top Guidelines Of Kentucky Farm Bureau

If you're an occupant, you're not off the hook for insurance. A great ndependent insurance coverage representative can stroll you through the actions of covering the fundamentals of both home owners as well as renters insurance coverage.3. Umbrella Policy An umbrella plan is a sort of insurance policy that includes an additional layer of protection for you and your assets when you require protection that goes beyond the limits of your home owners or car insurance policy. For instance, if you're at mistake for a multiple-vehicle accident, clinical costs and property damages might rapidly include up to greater than your car insurance policy will cover.

Dave recommends an umbrella policy for any individual with an internet well worth of $500,000 or even more. For a couple of hundred dollars a year, an umbrella policy can boost your responsibility coverage from the basic $500,000 to $1. 5 million. Talk with a Supported Regional Provider to identify the kind of insurance coverage that's right for you and your family members.

Life Insurance Companies Near Me for Beginners

Wellness Insurance Medical financial obligation adds to nearly half of all insolvencies in America according to the Kaiser Family Members Foundation. One unforeseen significant clinical emergency situation could amount to hundreds of thousands of great post to read dollars of costs.One alternative is a high-deductible health insurance strategy combined with a Health Cost Savings Account (HSA). With a high-deductible strategy, you are accountable for even more of your up-front healthcare expenses, however you'll pay a reduced month-to-month costs. A high-deductible health insurance certifies you to open an HSAa tax-advantaged interest-bearing account specifically for paying medical costs.

Other HSA advantages include: Tax reduction. You can subtract HSA contributions from your gross pay or organization revenue. In 2017, the tax obligation reduction is $3,400 for songs as well as $6,750 for wedded couples. Tax-free development. You can spend the funds you contribute to your HSA, and also they grow tax-free to use currently or in the future.

The Only Guide for Cancer Life Insurance

You can make use of the money tax-free on qualified medical expenditures like medical insurance deductibles, vision as well as oral expenses. Some business currently offer high-deductible health insurance with HSA accounts as well as conventional medical insurance strategies. Contrast your options as well as see if a high-deductible strategy could wind up saving you cash.Long-Term Special needs Insurance coverage Lasting handicap insurance policy safeguards you from loss of earnings if you are incapable to work for a lengthy duration of time because of an ailment or injury. Don't assume a permanent handicap could sideline you as well as your capability to work? According to the Social Protection Management, simply over one in 4 these days's 20-year-olds will become disabled before reaching age 67.

Report this wiki page