The Best Guide To Boomerbenefits.com Reviews

Wiki Article

What Does Boomerbenefits Com Reviews Do?

Table of ContentsNot known Incorrect Statements About Boomerbenefits.com Reviews The Buzz on Manhattan Life AssuranceHearing Insurance For Seniors Can Be Fun For AnyoneThe Definitive Guide for Aarp Medicare Supplement Plan FTop Guidelines Of Boomerbenefits Com Reviews

They have additionally updated Justice in Aging's Improper Payment Toolkit to integrate references to the MSNs in its version letters that you can make use of to advocate for customers that have actually been improperly billed for Medicare-covered solutions. that will certainly alert carriers when they refine a Medicare claim that the person is QMB and has no cost-sharing obligation. These changes were arranged to go into result in October 2017, yet have been postponed. Learn more regarding them in this Justice in Aging Concern Brief on New Methods in Combating Improper Billing for QMBs (Feb. 2017). (by mail), even if they do not also get Medicaid. The card is the system for wellness care carriers to bill the QMB program for the Medicare deductibles and co-pays.

Links to their webinars and also various other resources goes to this web link. Their details consists of: September 4, 2009, updated 6/20/20 by Valerie Bogart, NYLAG This post was authored by the Empire Justice.

The Buzz on Boomerbenefits Com Reviews

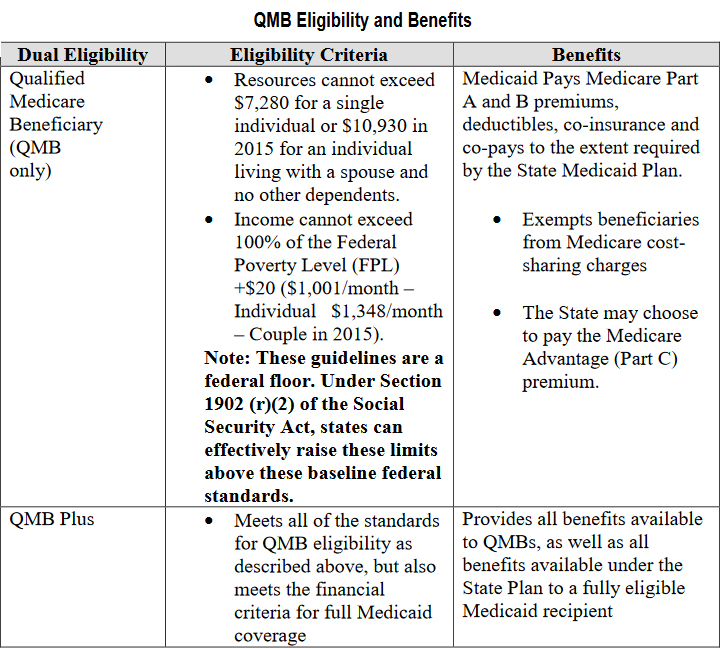

Each state's Medicaid program pays the Medicare cost-sharing for QMB program members. Anybody who receives the QMB program does not have to spend for Medicare cost-sharing and can not be billed by their healthcare providers. If an individual is taken into consideration a QMB Plus, they meet all standards for the QMB program yet also fulfill all economic demands to obtain full Medicaid services.

The first step in registration for the QMB program is to find out if you're qualified. You can ask for Medicaid dig this to offer you with an application type or situate a QMB program application from your state online.

There are instances in which states may limit the amount they pay wellness care service providers for Medicare cost-sharing. Even if a state restricts the quantity they'll pay a carrier, QMB members still don't have to pay Medicare companies for their healthcare costs and it's versus the law for a supplier to inquire to pay - what is medicare plan g.

Normally, there is a costs for the strategy, but the Medicaid program will certainly pay that premium. Many individuals choose this additional protection since it provides routine oral as well as vision treatment, as well as some come with a fitness center subscription.

The Greatest Guide To Plan G Medicare

Select which Medicare intends you would certainly such as to contrast in your location. Compare prices side by side with plans & service providers readily available in your location.He is included in several magazines in addition to writes consistently for various other skilled columns concerning Medicare.

Numerous states allow this throughout the year, but others restrict when you can enroll partly A. Bear in mind, states make use of various policies to count your earnings and assets to figure out if you are eligible for an MSP. Instances of revenue consist of earnings as well as Social Security advantages you receive. Examples of properties include examining accounts and stocks.

And some states do not have a possession limitation. If your income or properties appear to be over the MSP guidelines, you need to still use if you require the assistance. * Qualified Impaired Functioning Individual (QDWI) is the 4th MSP as well as pays for the Medicare Component A premium. To be eligible for QDWI, you have to: Be under age 65 Be working yet remain to have a disabling disability Have limited earnings and also possessions And, not currently be eligible for Medicaid.

The 8-Second Trick For Largest Retirement Community In Florida

20 for each brand-name medication that is covered. Bonus Aid just uses to Medicare Part D.

Different states might have different ways to calculate your revenue and resources. Allow's analyze each of the QMB program qualification criteria in more information listed below.

The regular monthly revenue limit for the QMB program enhances each year. Resource restrictions, In addition to a month-to-month revenue limit, there is likewise a resource restriction for the QMB program.

The Manhattan Life Assurance Diaries

Like revenue restrictions, the source limits for the QMB program are different depending on whether or not you're married. For 2021, the source limitations for the QMB program are: $7,970 $11,960 Resource limitations likewise increase yearly. Similar to revenue limits, you need to still look for the QMB program if your resources have a little enhanced.Report this wiki page